Introduction

The Indian startup ecosystem continues to evolve with every funding cycle. While the global funding environment has been cautious, India still shows strong activity in selective sectors and stages. Last month’s funding trend highlights an important reality: investors are still deploying capital, but decision-making has become more rigorous and founders are expected to demonstrate stronger fundamentals.

This blog breaks down the key funding trends observed last month and what Indian founders should learn to prepare better, raise smarter, and build sustainably.

1) Funding Is Happening, But With Higher Standards

One clear pattern from last month: funding is not “stopped.” It is simply more selective. Investors are prioritizing startups with:

- Clear revenue visibility

- Sustainable unit economics

- Strong founder-market fit

- Focused business model

- Clear go-to-market execution

Founder learning: It’s no longer about storytelling alone; it’s about proof.

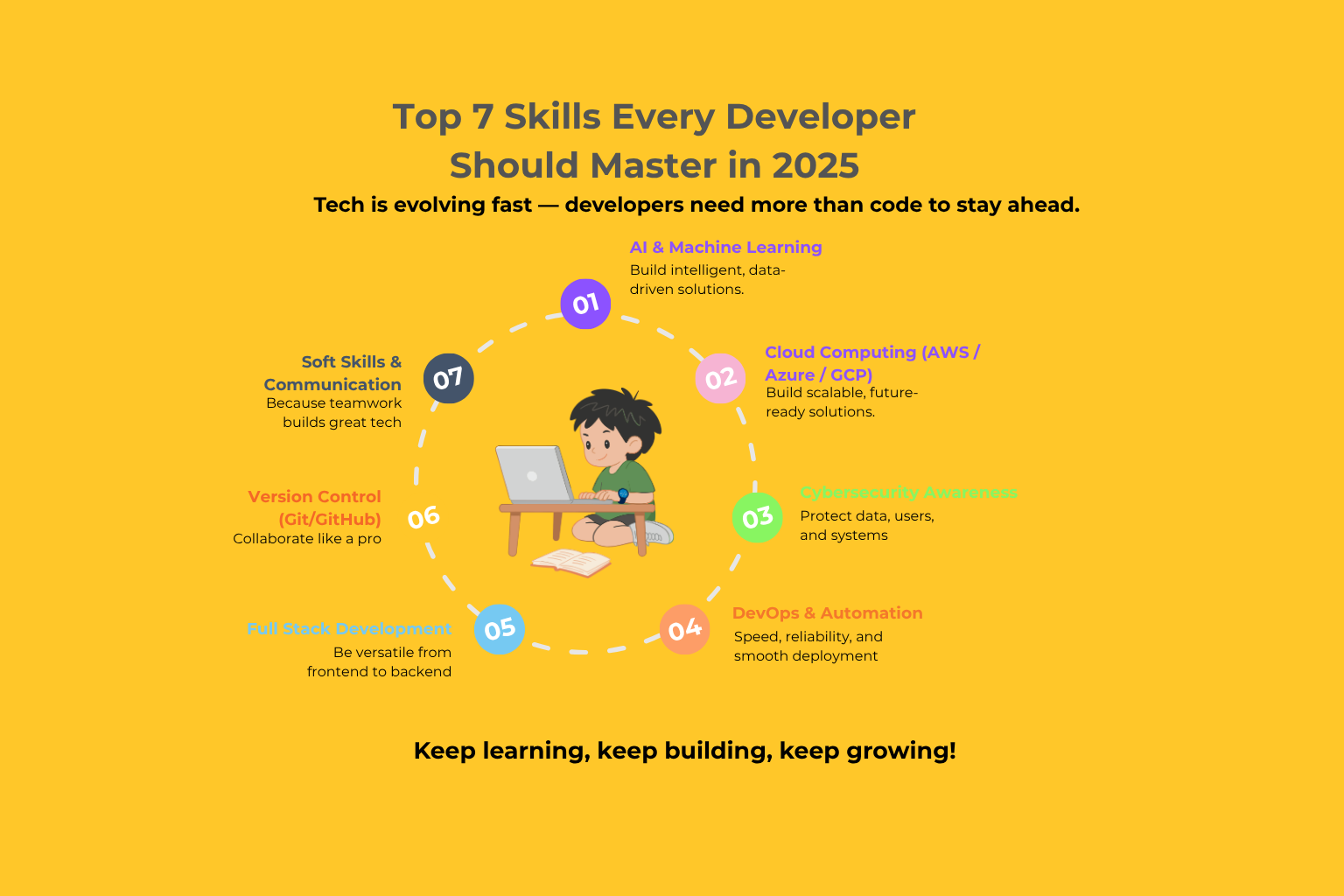

At Sarnit Infotech, we integrate AI models into web and mobile applications to deliver intelligent digital experiences. Developers skilled in AI and ML have a major edge in the coming decade.

) Seed Funding Remains Active — But Smaller and More Strategic

Seed rounds are still being closed frequently, but deal sizes are often smaller and structured carefully. Investors are spreading risk by funding:

- Teams with early traction

- B2B startups with predictable customer value

- Deep tech with defensible innovation

- Niche category creators

Founder learning: Build traction early. Your early metrics and customer feedback now matter more than polished pitch decks.

Our teams at Sarnit Infotech specialize in AWS and Azure cloud solutions, ensuring our projects are always optimized for performance and cost-efficiency. Developers who master cloud environments will lead tomorrow’s digital transformation.

3) Investors Prefer Startups With Strong Unit Economics

Last month’s trends again reinforced a key point: capital efficiency is back in focus. Investors are actively asking:

- CAC vs LTV ratio

- Payback period

- Gross margins

- Retention metrics

- Burn multiple

Founder learning: Growth without efficiency is no longer impressive. You must show scalable economics.

Security is at the heart of every project we deliver. At Sarnit Infotech, our developers follow OWASP guidelines and perform routine code audits to ensure end-to-end protection

Let’s Build Your Success Story Together

Partner with SarNit Infotech’s App Solutions team to create powerful, secure, and user-friendly apps that deliver results and elevate your brand experience.

4) Bridge Rounds and Extensions Are Common

Many startups are raising bridge rounds, internal extensions, or smaller top-ups to extend runway rather than pursuing aggressive valuation jumps. This indicates:

- Market is still valuation-conscious

- Investors prefer safe follow-ons

- Startups want 12–18 months runway buffer

Founder learning: Plan fundraising before you need it. Runway planning is now a founder’s core skill.

At Sarnit Infotech, we integrate DevOps practices across all our projects to ensure efficiency and scalability. Developers with DevOps expertise will continue to be highly sought-after in 2025.

5) Sector Preferences Shift With Market Needs

Funding last month also showed sector-specific confidence. Investors remained drawn to segments that solve clear market problems, such as:

- Fintech (especially lending infrastructure, risk, compliance)

- SaaS / B2B tools

- AI-driven productivity and automation

- Healthcare and diagnostic solutions

- EV ecosystem and climate-tech

Founder learning: Investors want market relevance. If your product is “nice to have,” your fundraising will take longer.

We at Sarnit Infotech excel in Laravel and React-based full-stack development, creating robust, scalable applications for clients across multiple industries. In 2025, the demand for full-stack developers will continue to grow exponentially.

6) Due Diligence Is Deeper Than Before

Unlike earlier boom phases, last month’s rounds indicate stronger compliance checks. Investors now go deeper into:

- Revenue proof and invoices

- Contract audits

- Legal structure and cap table hygiene

- ESOP clarity

- GST and tax compliance

Founder learning: Clean documentation increases investor confidence and speeds up deals. Poor compliance delays or kills rounds.

Our design and development teams collaborate closely to ensure that every digital product we build is user-friendly, visually appealing, and conversion-focused. Developers who understand UI/UX create experiences that drive results.

7) Founder Credibility and Execution Discipline Matter More

One subtle but powerful trend: investors are betting on execution discipline. Founders who show:

- Clarity of priorities

- Hiring discipline

- Focus on profitable growth

- Strong monthly reporting and planning

…are finding it easier to raise.

Founder learning: Being “operator-first” is now a strong fundraising advantage

We encourage our developers to engage in brainstorming sessions, peer reviews, and collaborative problem-solving. Technical excellence combined with strong communication defines a true professional.

What Indian Founders Should Do Next (Action Plan)

Step 1: Improve Metrics Before Pitching

Before reaching investors, ensure your startup has:

- Strong customer proof (testimonials, retention)

- Clear product-market positioning

- Basic unit economics in place

Step 2: Build a Fundraising Narrative Around Proof

Your pitch should clearly answer:

- What problem do you solve?

- Why you? Why now?

- What traction validates the demand?

- What are your economics?

- What will the investment achieve?

Step 3: Prepare Investor-Ready Documentation

Keep ready:

- Deck + one-pager

- Financial model (12–18 months)

- Cap table

- Company incorporation + compliance docs

- Key contracts

Step 4: Raise Smart, Not Big

Instead of overfunding, raise what you need to hit clear milestones:

- Product improvement

- Revenue targets

- Expansion experiments

- Strong hiring for key roles

The future of technology will be built by developers who adapt, innovate, and collaborate. Whether it’s mastering AI, cloud computing, cybersecurity, or full-stack development — continuous learning is the real superpower.

Conclusion

Last month’s startup funding trend delivers a clear message: Indian startup funding is alive, but founders must adapt. The winners in this environment are not those who chase the biggest valuations, but those who build strong fundamentals, show traction, and manage capital efficiently.

For founders, this is not a slowdown—it is a maturity phase. Those who learn, prepare, and execute well will raise capital and build long-term market leaders.

The future of technology will be built by developers who adapt, innovate, and collaborate. Whether it’s mastering AI, cloud computing, cybersecurity, or full-stack development — continuous learning is the real superpower.

Custom Plans – Hire Us Per Hour

Flexible hourly-based hiring to fit your project’s scale, budget, and timeline.

Pay only for the services you need, when you need them.

Starter Plan

₹350 / Hour

Ideal for basic website development and small updates. Best For: Static websites, UI adjustments, minor bug fixes.

- Static Website (4–5 Pages) (30–40 hours)

- Basic SEO Setup (10 hours)

- Landing Page Design (8–12 hours)

Growth Plan

₹400 / Hour

Perfect for medium-sized projects with advanced features. Best For: Dynamic websites, LMS, moderate e-commerce platforms.

- Dynamic Website (6–10 Pages)(50–70 hours)

- E-Commerce Setup (70–90 hours)

- Custom API Integrations (20–30 hours)

Premium Plan

₹500 / Hour

Designed for complex, large-scale projects requiring expert skills. Best For: Full-stack apps, enterprise portals, cloud integrations.

- Web + Mobile App Combo (120–150 hours)

- ERP/CRM Development (180–200 hours)

- UI/UX-Optimized Custom Dashboards (80–100 hours)